Cheat Sheet: Understanding UK Taxes: Personal vs. Company Ownership

In the UK, property ownership can be structured through personal ownership or via a limited company (Ltd). Each option has distinct tax implications that can significantly affect an investor’s net return.

I – Tax implications under Personal Ownership of Property

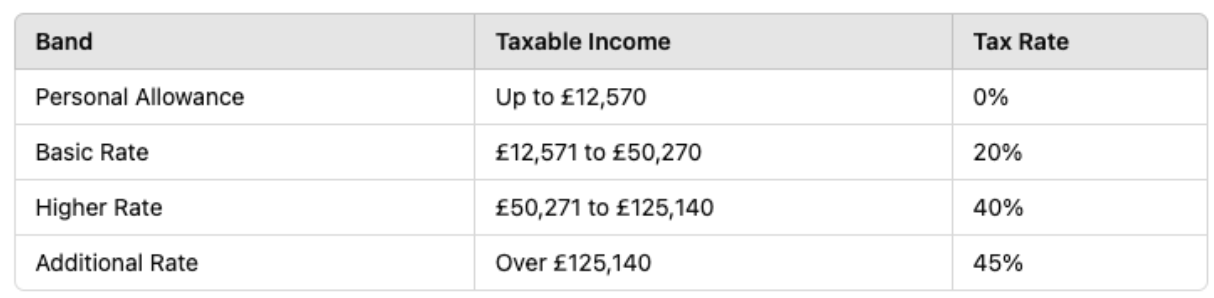

1) Income Tax: Individuals pay income tax on rental income at personal tax rates, which are structured as follows:

Personal Income Tax Brackets in the UK

Non UK Residents: Tax is paid only on UK rental income (not global income).

2) Capital Gains Tax (CGT): Tax on profits when selling a property that is not a primary residence. The rates are:

- 18% for basic-rate taxpayers

- 24% for higher-rate taxpayers.

Non UK Residents: Tax is payable only on capital gains from UK properties, with the same rates (18% or 28%).

3) Stamp Duty Land Tax (SDLT): Progressive rates based on property value:

- 0% up to £250,000

- 2% on the portion between £250,001 and £925,000

- 5% on the portion between £925,001 and £1.5 million

- 10% on the portion between £1.5 million and £2 million

- 12% on the portion above £2 million.

Non UK residents: Pay a 2% surcharge on top of standard SDLT rates for residential properties over £40,000.

II – Tax implications under Company Ownership (LTD) of Property

1) Corporation Tax:

- 19% on profits up to £50,000

- 25% on profits above £50,000.

- Limited Companies pay Corporation Tax on profits from the sale of assets, including property, with no separate Capital Gains Tax applicable.

Mortgage Interest Relief:

Unlike personal ownership, Limited Companies can deduct 100% of mortgage interest payments as a business expense, reducing taxable profits. This can provide significant savings for properties with high leverage.

2) Capital Gains Tax for Companies:

There is no separate Capital Gains Tax for companies; profits from asset sales are taxed under Corporation Tax.

3) Dividend Tax:

Dividend Tax: Applicable only when profits are distributed to shareholders (Ie: money sent outside the LTD):

- 8.75% on dividends within the basic rate band

- 33.75% on dividends in the higher rate band

- 39.35% on dividends in the additional rate band.

Retained Earnings: Profits retained for reinvestment do not incur dividend tax, allowing companies to grow without immediate tax implications for shareholders.

4) Stamp Duty Land Tax (SDLT):

Both companies and individuals pay Stamp Duty Land Tax (SDLT) based on the purchase price of the property.

III – Key Comparisons

Factors to Consider

- Rental Income: Higher rental income may benefit from company ownership due to lower tax rates on profits below £50,000.

- Future Sales: Selling properties under a company structure may yield different CGT implications (25% for companies versus 18-28% for individuals).

- Long-term Investments: Companies can offer better tax planning strategies for long-term investments.

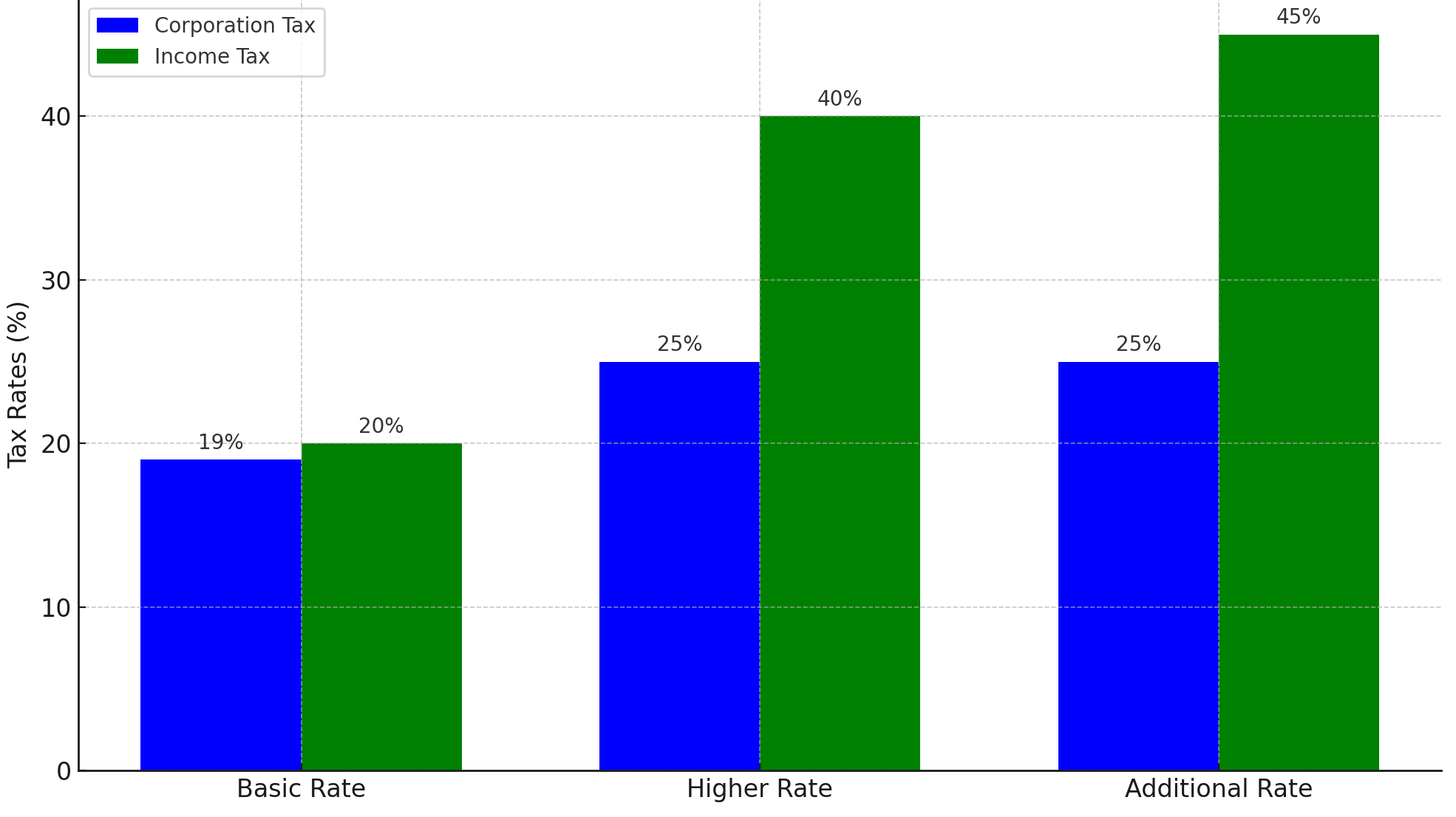

Comparison of Corporation Tax vs. Income Tax

IV – Other tax to consider

- Annual Tax on Enveloped Dwellings (ATED): Applies to companies owning UK residential properties valued over £500,000, with rates based on property value. If held in an Ltd, reliefs may be available for rental businesses or property developers. (provided not used by owner or relatives)

- Inheritance Tax (IHT): Charged at 40% on UK properties above the £325,000 threshold, even for non-resident owners. If held in an Ltd, IHT applies to the value of the company shares, not the property itself, allowing potential tax planning benefits.

Please note, the above information is for general marketing purposes only and does not constitute tax advice; we strongly recommend consulting a qualified tax adviser for personalised guidance tailored to your circumstances.

Source: HM Revenue & Customs (HMRC)

Karim Salame – [email protected]

McGardens Estate | November 2024 | www.mcgardens-estate.com