White Paper – Navigating Transitions in THE UK Real Estate Market: 2024 and Beyond

The UK real estate market is in the midst of significant transitions, influenced by shifting economic conditions, changing investor preferences, and evolving sector dynamics. From the rise of the residential sector to the challenges facing commercial offices, these changes are reshaping the landscape of property investment in the UK. This article explores the key transitions happening in the market, what’s driving them, and what they mean for the future of UK real estate.

1. The Rise of the Residential Sector

One of the most notable transitions in UK real estate is the growing dominance of the residential sector. In 2024, this sector has outperformed others, with investment volumes reaching £4.8 billion in the first half of the year, marking a 14% increase from the previous year. This growth is primarily driven by the demand for quality living spaces, particularly single-family rentals and Purpose-Built Student Accommodation (PBSA).

The surge in residential investment reflects changing demographics and lifestyle preferences. People are increasingly seeking flexible, high-quality housing options that cater to various needs, from family living to student accommodation. The government’s focus on addressing housing shortages and supporting infrastructure projects has further fueled this trend, making residential real estate an attractive and resilient investment option.

2. Challenges in the Office Sector

While the residential sector is booming, the office market is facing a significant transition of its own. Investment volumes in the office sector have dropped to £3.3 billion in the first half of 2024, a 30% decrease compared to the same period in 2023. This decline is partly due to the evolving demands of office spaces in a post-pandemic world.

Investment by Sector:

As remote work and flexible office arrangements become more common, the traditional office market is under pressure to adapt. Older office buildings that do not meet modern standards are struggling to attract tenants and investors. The focus is now shifting towards well-located, high-quality office spaces that offer a blend of flexibility, sustainability, and modern amenities. This has led to a wave of refurbishments and repurposing efforts, as owners seek to modernise outdated properties to meet new market demands.

3. Retail and Industrial Shifts

The retail sector has been undergoing a transition driven by changing consumer behaviors and the rise of e-commerce. While retail investment volumes fell slightly to £2.9 billion in the first half of 2024, investor confidence is slowly returning. Stabilising prices and the potential for growth, especially in the out-of-town retail and grocery sub-sector, have sparked renewed interest among investors.

Despite a slight decrease in investment volumes to £2.6 billion, demand for logistics assets remains strong. The industrial and logistics sector, on the other hand, continues to evolve in response to the increased importance of supply chains and e-commerce. However, limited supply and vendor motivation have constrained transactions, highlighting the need for innovative approaches to meet the growing demand for industrial and logistics spaces.

4. The Hotel Sector’s Resurgence

Another key transition in the UK real estate market is the resurgence of the hotel sector. Investment volumes have soared by 170% in the first half of 2024, reaching £2.1 billion. This sector has proven resilient, with large portfolio and entity-level deals driving significant activity. The demand for hospitality and tourism is rebounding, and investors are capitalizing on this trend by focusing on well-located and high-quality hotel assets.

This resurgence indicates a broader recovery in the leisure and hospitality industry, as travel and tourism pick up pace. The hotel sector’s strong performance suggests that investors are increasingly optimistic about the long-term prospects of hospitality real estate.

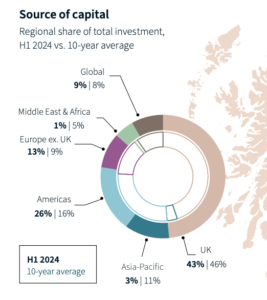

5. The Growing Influence of International Capital

International capital plays a vital role in shaping the UK real estate market. Overseas investors accounted for 52% of total investment in the first half of 2024, with the USA leading as the largest source of capital, followed by the Middle East and Europe. London remains a key attraction for international investors due to its liquidity, transparency, and long-term stability. The continued flow of international capital into the UK highlights the country’s appeal as a safe and lucrative investment destination.

However, this dynamic also underscores the need for UK real estate to remain adaptable and competitive in a global market, particularly as investor preferences and market conditions evolve.

6. Future Outlook and Strategic Adaptations

The transitions currently underway in the UK real estate market present both challenges and opportunities. As economic conditions gradually improve and interest rates begin to stabilize, the market is poised for growth in certain sectors. Logistics, data centers, and energy infrastructure are expected to offer resilience and new investment opportunities in the coming years.

Investors and developers will need to adopt agile and creative strategies to navigate these transitions successfully. This includes focusing on sectors that show growth potential, adapting to changing demands in office and retail spaces, and capitalizing on the strengths of the residential and hotel markets. By embracing these shifts, stakeholders can position themselves for success in an evolving real estate landscape.

Conclusion

The UK real estate market is experiencing significant transitions that are reshaping the investment landscape. From the rise of the residential sector to the challenges in office spaces, each shift presents unique opportunities and risks. As we look to the future, adaptability and strategic planning will be key to thriving in this dynamic market. Whether it’s navigating the growing influence of international capital or responding to changing demands in various sectors, the ability to adapt will define success in UK real estate.

Karim Salame – [email protected]

McGardens Estate | September 2024 | www.mcgardens-estate.com