Market Snap: Latest Updates on the European Real Estate Market in 2024

The European real estate market is undergoing significant changes in 2024, influenced by central bank policies, fluctuating mortgage rates, and evolving regulatory environments. As mortgage rates decline and prime property markets experience varied growth, understanding these dynamics is crucial for investors and homeowners alike. Here’s a breakdown of the latest developments and what they mean for the European real estate market.

1. Mortgage Rates: A Turning Point in Europe

The European Central Bank (ECB) recently made its second rate cut, lowering the deposit rate to 3.5%, marking a significant shift since July 2023. This move positions the ECB ahead of both the Federal Reserve and the Bank of England, each of which has only implemented one rate cut so far.

The reduction in rates has directly impacted mortgage rates across Europe. Following the ECB’s first rate cut in June, we’ve seen a downward trend in mortgage rates. The recent announcement signals that further reductions are on the horizon, providing a positive outlook for the 20% of households in the European Union with variable-rate mortgages.

In countries like France and Italy, mortgage rates have already seen significant drops. France’s average mortgage rate has fallen to 3.41%, and Italy’s to 3.44%, both from previous highs during the last monetary tightening cycle.

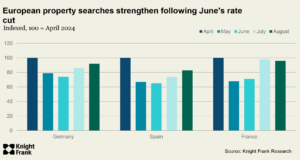

This easing of rates has boosted buyer confidence, with property searches for key European markets increasing by 29% since June.

However, uncertainty remains around the ECB’s next steps. While President Christine Lagarde hinted at the possibility of further cuts not occurring until December, other ECB officials and market strategists express caution due to ongoing inflation concerns. Future rate decisions will likely be influenced by GDP data, Federal Reserve policies, and currency market impacts.

2. Prime Prices: Slower Growth in Luxury Markets

The luxury residential market in Europe is showing signs of slower growth. According to the latest Prime Global Cities Index by Liam Bailey, annual price growth for luxury properties in 13 European cities averages a modest 0.8% as of June 2024, a contrast to the 2.6% average across 44 global cities. Several factors contribute to this subdued growth in European cities:

Interest Rate Impact: European markets, especially those with a high proportion of variable-rate mortgages, were significantly affected by the interest rate hikes that began in 2022. This has led to greater caution among luxury property buyers.

Economic and Policy Influences: Economic uncertainty, reduced pandemic savings, and recent policy and tax changes targeting wealth and property have added to the cautious approach of buyers.

Regional Variations: Despite the overall slower growth, cities like Madrid, Lisbon, and Dublin have bucked the trend, with price increases of 6.4%, 4.7%, and 4.5%, respectively. This suggests a correlation between economic output and prime price performance, with southern European economies expected to outperform their northern counterparts this year.

3. Policy Shifts and Their Impact on Real Estate

The pace of policy changes across European housing markets is accelerating, making it challenging for investors to keep up. These policy shifts are expected to become even more rapid in the final quarter of 2024, affecting property ownership and rental regulations. Key developments include:

- Italy’s Flat Tax: The flat tax has doubled, potentially impacting high-net-worth individuals and investors.

- France’s Tax Direction: Uncertainty remains around France’s tax policies, but more details are expected soon following Michel Barnier’s appointment as Prime Minister.

- UK Autumn Budget: The UK is awaiting its Autumn Budget to clarify non-dom status, possible changes to Capital Gains Tax, and rules around carried interest.

- Golden Visa and Talent Schemes: Greece has tightened its Golden Visa rules, and Portugal has introduced a Talent Attraction Scheme to lure skilled professionals.

- Tourism Regulations: Barcelona plans to ban holiday lets from 2028, and Greece has announced a one-year ban on new holiday lets in areas around Athens.

These changes reflect broader concerns about housing affordability, over-tourism, and high debt levels in Europe. As governments push for increased transparency and regulation, we expect these factors to continue shaping market performance.

4. Additional Trends and Insights

Beyond mortgage rates and policy shifts, other factors are influencing the European real estate market:

- Working from Home: This trend is most prevalent in northern European cities, impacting residential market dynamics as people seek properties that accommodate remote work.

- Political Changes: France, Italy, and Spain have secured key roles in the new European Commission, which may influence future economic and housing policies.

- Global Events Impact: The influence of major events, like the Olympics in Paris, shows how global happenings can reshape city markets and drive investment.

Conclusion

The European real estate market in 2024 is marked by transitions, from falling mortgage rates and shifting luxury property prices to evolving policy landscapes. For investors and homeowners, staying informed and adaptable is key in navigating these changes. As we monitor the ECB’s next moves and regional policy shifts, opportunities will continue to emerge for those ready to take advantage of this dynamic market.

Karim Salame – [email protected]

McGardens Estate | September 2024 | www.mcgardens-estate.com

Source: Knight Frank European Residential Update Report, 09.2024